Buying a Home for the First Time: An Introductory Guide to Loans and Programs

In the ever-changing real estate market of the United States, first-time home buyers often face a daunting task when it comes to choosing the right mortgage. However, a variety of mortgage options cater specifically to the needs of first-time buyers, each with its unique benefits and restrictions.

FHA Loans

One of the most popular choices for first-time buyers is the Federal Housing Administration (FHA) loan. These loans are appealing due to their low down payment requirements, which can be as low as 3.5%, and flexible credit score minimums, typically around 580. However, it's important to note that FHA loans require mortgage insurance premiums to protect the lender's stake in the loan in case of default[1][3].

VA Loans

For eligible veterans and military members, VA loans offer a fantastic opportunity. These loans come with a 0% down payment, no private mortgage insurance (PMI), and often lower interest rates than conventional loans[3].

USDA Loans

Targeted at low- to moderate-income buyers in eligible rural and some suburban areas, USDA loans are another attractive option. They provide 0% down payment with income and location restrictions. USDA loans often have lower mortgage insurance costs than FHA loans and can combine home purchase and renovation financing in a single loan[2][3][4].

Conventional Loans

Conventional loans backed by Fannie Mae or Freddie Mac can require as little as 3% down for qualified buyers with good credit. PMI is required if the down payment is less than 20%[1][3].

State and Local Programs

State and local programs offer loans and assistance programs tailored to the borrower's location. For example, Texas offers TDHCA programs to moderate-income buyers with grants or loans for upfront costs[3].

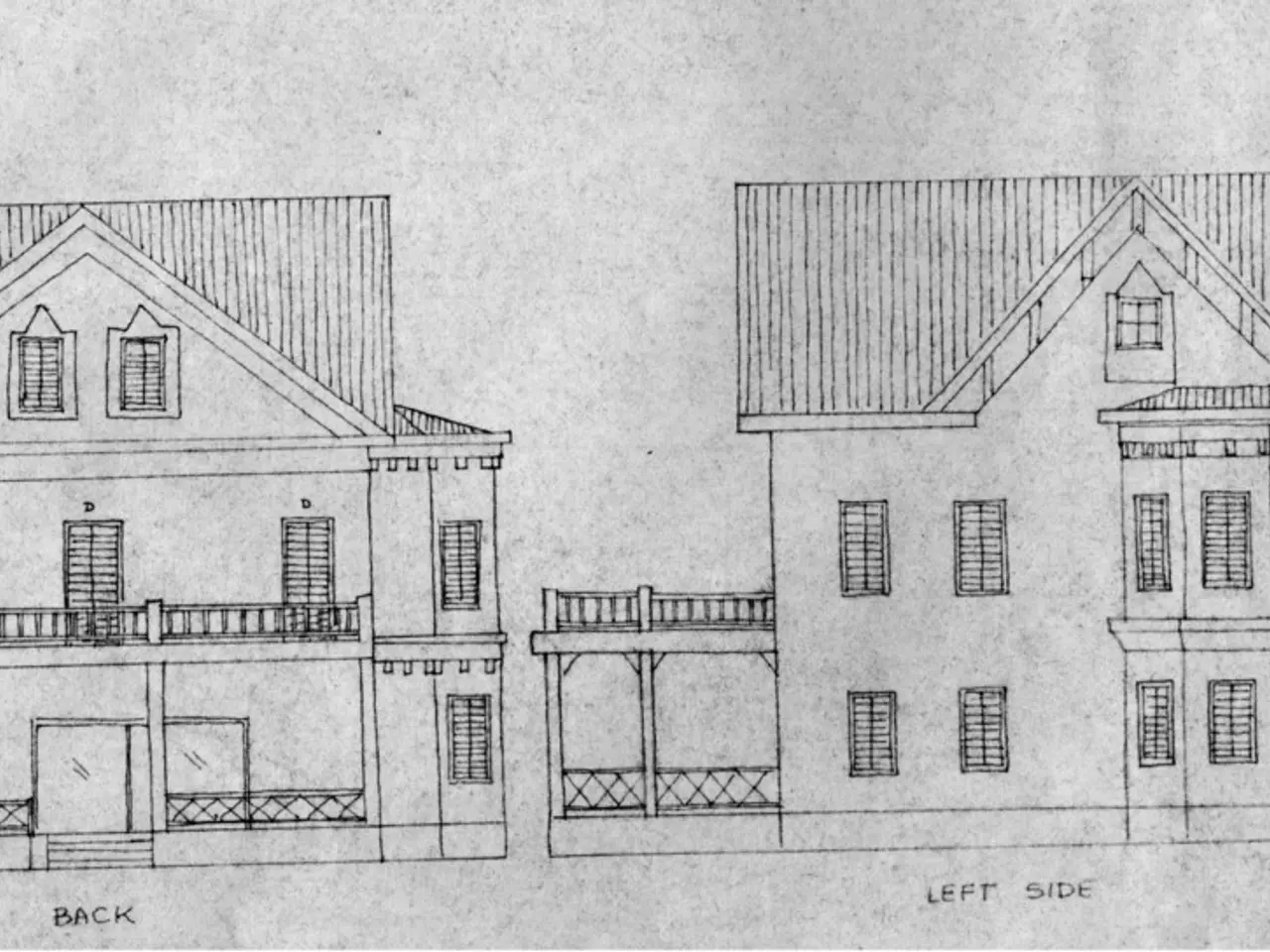

Renovation Loans

Renovation loans such as USDA renovation loans or FHA 203(k) allow buyers to purchase homes needing repairs and finance renovations in one mortgage. USDA renovation loans require the property to be in eligible rural areas and include limits on luxury additions[2].

In summary:

| Loan Type | Down Payment | Credit Requirements | Key Benefits | Restrictions | |----------------------|------------------------------|---------------------------------|------------------------------------------------|-------------------------------------| | FHA loan | ~3.5% | Minimum ~580 | Flexible credit, low down payment | Mortgage insurance premium required | | VA loan | 0% | Eligible military/veterans | No PMI, no down payment, low interest | Must qualify as eligible veteran | | USDA loan | 0% | Income limits, location-based | Low insurance, combines renovation financing | Rural area, income limits | | Conventional loan| 3%+ | Generally 620+ credit score | Competitive rates with good credit | PMI if <20% down | | State/local programs | Varies with assistance | Often aligns with primary loan | Down payment/closing cost help | Usually income or residency limits | | Renovation loans | Varies (depends on loan) | Varies | Finance purchase + repairs in one loan | Property/location restrictions |

Choosing the best option depends on credit score, income, location, military status, and property conditions. Many lenders offer multiple loan types and homebuyer assistance tools to find suitable grants and discounts, such as Chase and New American Funding[1].

First-time buyers should evaluate these options based on eligibility, financing needs, and available assistance programs in their area. Additionally, it's worth noting that Fannie Mae's HomeReady loan requires 3% down, is for low-income borrowers with a credit score of 620 or higher, and allows mortgage insurance to be cancelled after building 20% equity[5]. Freddie Mac's Home Possible loan requires a minimum 3% down payment and allows for the use of gifts, grants, or loans for the down payment[6]. Fannie Mae and Freddie Mac offer conventional loan products, some with low down payments[7]. Lastly, an energy-efficient mortgage (EEM) helps finance energy-efficient homes or energy-saving upgrades[8].

[1] Chase. (2021). First-Time Homebuyer Programs. Retrieved from https://www.chase.com/personal/home-loans/first-time-homebuyer-programs

[2] USDA. (2024). USDA Loans: Eligibility & Requirements. Retrieved from https://www.usda.gov/topics/rural-development/housing/single-family-housing-direct-home-loans/eligibility-requirements

[3] MyFICO. (2021). FHA Loan Requirements. Retrieved from https://www.myfico.com/credit-education/loans/fha-loan-requirements

[4] Freddie Mac. (2021). CHOICERenovation. Retrieved from https://www.freddiemac.com/single-family/products/choicerenovation

[5] Fannie Mae. (2021). HomeReady. Retrieved from https://www.fanniemae.com/content/guide/selling/b3-2-06.pdf

[6] Freddie Mac. (2021). Home Possible. Retrieved from https://www.freddiemac.com/single-family/products/homepossible

[7] Fannie Mae. (2021). Conventional Loans. Retrieved from https://www.fanniemae.com/content/guide/selling/b3-2-07.pdf

[8] U.S. Department of Energy. (n.d.). Energy-Efficient Mortgage (EEM) Program. Retrieved from https://www.energy.gov/energysaver/articles/energy-efficient-mortgage-eem-program

- To navigate the homebuying process more accurately, first-time buyers can make use of a financial calculator app for estimating mortgage payments, calculating savings, and understanding investment opportunities in the home-and-garden sector.

- After comparing various loan options, such as FHA, VA, USDA, and conventional loans, it's essential to make sure that personal lifestyle factors, including income and credit score, match the eligibility requirements.

- For those interested in state or local homebuyer assistance programs, researching and contacting departments of housing and urban development, local government agencies, or community organizations could provide insight into available programs and benefits for personal-finance needs.

- Realizing that managing finances is an ongoing process, it's crucial to allocate time each month for budgeting, saving, and assessing how mortgage payments fit into the bigger picture of overall financial management.

- To take full advantage of low interest rates and cost saving opportunities, aspiring homebuyers should explore renovation loans, which allow financing both home purchase and repairs in a single loan, making it easier to transform a fixer-upper into their dream home.

- Being informed about insurance requirements and offerings, whether it's mortgage insurance, homeowners insurance, or insurance for home renovations, is crucial to more effectively compare loans and protect investments.

- Lastly, intent on making the homebuying experience more seamless, it's advisable to seek advice and guidance from mortgage lenders who specialize in first-time buyer programs, providing valuable insights and recommendations tailored to an individual's financial lifestyle and real-estate goals.